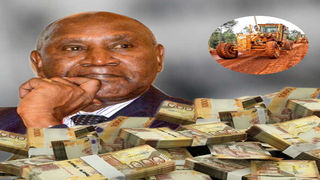

Pending bills verification committee chair Edward Ouko. Wheeler-dealers, rent-seekers and political elites with special interests are hovering around the committee.

|Weekly Review

Premium

Sh500 billion boon: Edward Ouko’s tough task handling wheeler-dealers, rent seekers eyeing contractors cash

At stake is a massive Sh566 billion of outstanding payments to government contractors with some of the claims having been on the State’s books since 2005.

The man chosen by President William Ruto to steward the difficult task is former Auditor-General Edward Ouko.

What is, however, raising eyebrows is the verification committee that was launched by the President on Tuesday. Included in the 20-member team are siblings of top political leaders and senior State officials.

Then there is the category of unsuccessful politicians in the last elections with no known domain knowledge and experience in auditing and whose only credential is the fact that they are cronies of powerful individuals within the Kenya Kwanza administration.

The category of top officials mainly drawn from State departments that hold the largest stocks of pending bills in their books command a lion’s share in terms of representation in the committee.

Finally, there is a sprinkle of individuals representing interest groups such the Law Society of Kenya and the Institute of Public Accountant of Kenya.

The reason eyebrows are being raised is that past experience in Kenya with pending bills verification committees has shown that you have a better chance of success when you have a team dominated by independent external parties and a sprinkle of retired public officials with experience in inner workings of government.

The 1988 pending bills verification committee that was headed by Harris Mule, said to be the most successful, was dominated by independents.

A pending bills verification committee stuffed with too many government officials is bound to be riven with conflict of interest because it amounts to appointing a poachers’ committee to advise you on how to reduce incidences of poaching in your national parks.

Mark you, this committee has been tasked with the politically high-stakes duty of scrutinising a massive mountain of outstanding payments to government contractors that have accumulated to a figure that calculates to nearly 20 per cent of the government’s annual budget.

The responsibility will include having to identifying the genuine claims from fake bills and to recommend what deserves to be paid and which should not.

Indeed, this is not going to be the usual routine and mundane audit exercise. It is a process that is going to be happening against the backdrop of heavy political undercurrents.

With the government budget shrinking by the day, and with budgetary appropriations for lucrative projects having dried up, activity around chasing pending bills and outstanding payments on behalf of contractors has become a big business it itself.

This space has spawned a veritable army of agents and brokers who make money from peddling influence and chasing the payments on behalf of well-connected contractors for a fee.

Pending bills space is increasingly being recognised as the new frontier for corruption and one of the spaces where rent-seeking elites test their political mettle.

Also Read: Runaway public debt: Heist or just hot air?

Which is why it does not surprise that powerful individuals were keen to have their cronies planted within the membership of the verification committee. What has raised the stakes even higher are the signals from the government that it is preparing to open the taps to clear these outstanding payments.

Speaking during the launch of the committee at State House, the Principal Secretary at the National Treasury, Dr Chris Kiptoo, announced that the government had reached an agreement with the International Monetary Fund that the pending bills be paid and cleared from the books.

“The new arrangement is that whatever we determine as payable, we will put it in the fiscal framework and decide whether it will be paid once, twice or in three instalments,” he said.

He also revealed the agreement with the IMF was that pending bills will henceforth be treated as a first charge on the budget that must be accommodated in subsequent supplementary budgets.

Furthermore, the stakes are high for rent-seeking elites in this latest process because the Ouko Committee has been tasked to go as far back as 2005. The committee will be scrutinising bills that occurred during the Mwai Kibaki years.

But will the committee crack the Sh566 billion bills headache? Here is a bit of background on how pending bills occur and why it remains one of the most intractable public financial management problem for Kenya.

What are pending bills? Call them outstanding payments or arrears: A case where a contractor builds a road for the government but is not paid within that specific financial year and accommodated in subsequent years.

In a good number of cases, pending bills in Kenya arise because of abandoned projects or as a result of disruptions of expenditure plans. When settlement of bills is delayed for decades, the pending bill problems become even more intractable.

When payment vouchers and certificates have to be kept in government offices for inordinately long periods and since record keeping standards within government offices are poor, the temptation to generate fake claims is very high.

Controversial idea

In the roads sector, contractors have especially become adept at the game of generating rents through pending bills.

All it takes is to have had a contract which for one reason or another, stalled. You make sure that you keep some of your equipment on site for as long as possible and you have the opportunity to charge excessive interest claims and penalty charges for as long as the project remains stalled.

Compounding the problem is the fact that government engineers who supervise projects collude with contractors to introduce changes and variations in the contracts.

Many years later, when the government appoints a bills verification committee to scrutinise and authenticate how much work was done, the road will have been washed away by rains.

The first bills verification committee was the Mule task force of August 1988. After scrutinising the stock of bills, that committee found out that out of a total stock of pending bills amounting to Sh22 billion, only those worth Sh13.3 billion were payable.

He recommended that the government appoints external auditors to determine the authenticity of the remaining bills. When the external auditors who were appointed in 2000 did the work, they found out that out of the remaining bills left by Mule’s team, only those worth Sh3.2 billion were authentic.

The government announced that it would not entertain submissions of pending bills relating to the period prior to 1988. Despite these efforts, pending bills were not eliminated because new claims continued to be submitted by suppliers and contractors.

In 2002, Finance Minister Chris Obure announced that the stock of pending bills had accumulated to Sh19 billion. It was at this point that the government came up with the highly controversial idea of settling bills with special bonds.

Well-connected contractors and suppliers were given bonds worth billions of shillings. One of the first moves to be made by the Kibaki administration in 2002 was to appoint a pending bills validation committee. It has been a vicious circle.