Prenuptial agreements, also known as prenups or antenuptial contracts, are entered into by couples before marriage to specify the terms of their property rights and potential support obligations in the event of divorce, separation or death.

In what might seem like a tale from a West African melodrama, a story made the rounds a few years ago about a long-suffering husband who had struggled to pay rent in an upmarket mansion for years.

Unbeknown to him, his wife was their landlady! It would also explain why the wife always put up a strong case for why they could not move to a more affordable neighbourhood.

While some people praised the wife as a shrewd money manager who ensured that her husband’s finances were not misused elsewhere, others castigated her for being deceptive. Often we hear about wealthy men who die but their wives are left in the dark regarding the extent of their husband’s wealth.

Many of those listed in Unclaimed Assets are men, whose families only come to know about stashes of cash or property long after the man is buried. A study by Bankrate Company revealed that more than 42 per cent of spouses in the US commit financial infidelity. Financial infidelity occurs when a married couple with combined resources keeps financial secrets from each other.

It is the concealing of resources, money, credit, debts investments, or other form of finance from your spouse. Financial infidelity among Kenyan couples is more common than we would like to imagine.

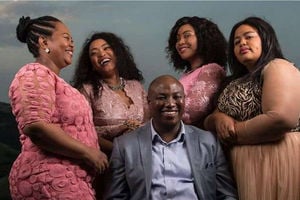

It is the most common form of infidelity among married Kenyan women, who also admit that they teach the same to their younger counterparts. We asked three women who have money secrets from their husbands to shed some light on this phenomenon.

Miriam Mugambi, 48

Miriam, a senior manager in a financial institution, says she did not start her marriage with any financial secrets. “I had heard about women who keep secret bank accounts, but that was against my Christian beliefs. So, I shared my payslip with my husband from day one, including any other funds I got such as Sacco dividends.”

But by the third year of marriage, Miriam realised that her husband had never disclosed his salary, nor shared any information about his income or finances. “He would get upset whenever I asked him.” In time, any attempts to discuss his salary led to violence.

“I have once been slapped because I asked him to be accountable for a loan I had procured on his behalf, which he was to repay through his salary.” After this experience, Miriam concealed the news of a promotion from her husband. “By good luck, the payslip system was now online, and I did not have to get printed copies.” This worked for a while, but things changed when she joined another employer.

“At the new organisation, I came to learn that he had a friend in the bank who told him how much I earned as my salary was channeled through that bank. Miriam later learned of other ways to circumvent this. “You can request your HR to split your salary into separate accounts.” She opted to use her Sacco account for a portion of her salary when she next changed employers, which came with a bigger pay.

“I don’t call this financial infidelity. It is protection of my children’s welfare and mine too,” Miriam says, adding that after 23 years of marriage, she still has no idea how much her husband earns, and is no longer interested in discussing it with him. “He too has no idea that I now have property in this city and other scattered investments, including in the money markets. Those are secured for my children.”

Necessity is the mother of invention, and it seems that financial infidelity is driven by a need to safeguard the women’s futures. “Women like security, for themselves and their children. I want to be safe in case of a rainy day because men can sometimes do crazy things.” According to Miriam, men can act in ways that can throw a woman off balance for a long time.

“One day you are happily married, and the next day you are kicked out. I have seen it happen many times. Or one day you are happily married, and the next minute you find out the man has another woman and so many secret responsibilities out there, then all of a sudden you stop getting enough for yourself and your children. For such reasons I advise women to keep their safety net for a rainy day.

Karen Ochieng, 52

“I learned the hard way that a woman must keep her finances away from her husband. They can use you and dump you then leave you destitute.” Karen says she was not wise with her money when she met her husband. “I should have seen the red flags early because I financed the better part of our wedding while he pocketed the money from the finance committee that our friends and family had formed to help offset wedding costs."

Like Miriam, Karen disclosed her financial status to her husband, including sharing her bank and mobile money PIN. “In marriage counselling they teach us that we are one in everything. The women take this literally, but the men are shrewd.” Karen says that her husband would beat about the bush whenever she asked about his finances. “He was in business, so he would tell me that money is never consistent.”

Karen, a human resources specialist, says that she learned to be discreet about her earnings from her husband, and now, she has become better than the master. “The financial infidelity on his part had escalated to crime. He once forged my signature and fraudulently sold a joint property to finance another woman’s lifestyle.”

Karen now buys assets under her mother’s name and all her financial information is kept under lock and key away from their home. “I discovered a lot more than I can share with you, but my experience has taught me to be discreet. Never trust a man, especially a husband, with your finances.”

Financial abuse, as Karen reveals, can lead a wife to take cautionary measures, including withholding financial support even when a need arises in the family. “We had a family crisis that I could have sorted with my chama savings, but once bitten, twice shy. I could not reveal that I had money.” She left her husband to his devices and slept soundly as he stayed up all night thinking of ways to raise funds.

Catherine Wambui, 47

An accomplished entrepreneur and managing director in one of the top corporates, Catherine says that she has always been careful to separate her finances from her husband’s. “First of all, I do not believe in joint accounts. We each meet our obligations, and everyone minds their money.” Catherine was clear from the onset that money matters are personal.

“When we need to do something major, we talk about it, agree on how much we both need to raise, then work on raising it.” Her husband has no idea how much she makes, and neither does he know about her savings or investments elsewhere. “Unless we have agreed on a joint investment, I never tell him.”

Also Read: Debunking marriage myths

Catherine says that she grew up with clarity about money and marriage after witnessing the serious conflicts money caused between her parents. “I saw how my mum was put in very awkward situations financially by my dad.” Her parents both earned salaries, but her father dictated how her mother’s earnings would be used, while her mother had no say about her father’s money.

It is no secret that money lessons during bridal showers encourage brides to be financially independent and smart. Is it that men cannot be faithful with money or is there more to this distrust? “Not really. It all depends on someone’s values. We live in a patriarchal society, where men have for centuries controlled resources,” Martin Njaga, a communications expert says.

“This creates an entitlement mentality in some husbands regarding their wife’s finances.” Catherine cautions women to be wary of husbands with questionable morals. “If he is adulterous, he will also cheat you financially. Open your eyes to these things while still dating.” Miriam admits that she is not averse to spouses opening joint accounts and being completely open about their respective finances.

“But this must only be after years in marriage when you get to understand the other person’s approach to finances. It is important to learn about someone’s financial management skills or lack thereof. Are they drowning in debt?” Globally, finance is rated among the top reasons for divorce, which is only preceded by adultery.

Money matters in marriage bring conflict, because people approach finances differently, and a lot of assumptions are made as a couple enters a marriage union.

While we learn about the social facets of relationships, money matters are rarely exhaustively dissected. During courtship, the man takes the bulk of the bills for coffees and dinner dates.

Both parties enter the marriage with a serious assumption that the man will still foot the bills, but things often change.

The wife can end up earning much more than the husband. What does this mean for the marriage? If a couple has not agreed on how they will handle money together, it may lead to serious problems. Divorce rates are higher when the wife earns more.

This is because social attitudes regarding women's and men's earnings sometimes cause rifts when the wife earns more. Men tie their worth to being the main breadwinner.

They therefore tend to develop insecure attitudes, feeling or fearing that their wives have lost respect for them. For this reason, some wives will not disclose a promotion or windfall at work or in their businesses.

“My mother earned more than my dad, but for many years, we did not know this. It was a top secret.” Catherine says that this caused a lot of distress to their mother. Some wives are forced to hand over their salaries to their husbands to massage their egos. “But no one can cure a man’s insecurity but himself,” Martin says.

Can we avoid financial infidelity in marriage? “Yes, but only if we can be completely honest and open about finances, including debts. “Money will either build or break you. You need to talk about it often during marriage. If you see a red flag before saying ‘I do’, do not ignore it. A leopard doesn’t change its spots just because you called it a goat.”

From the expert

Muthini Mathenge is a lawyer whose job is to register cautions and restrictions for spouses seeking to protect their interests. She also handles succession disputes especially in cases where ‘beneficiaries’ materialise only once a death occurs.

“These disputes would never arise if the property was in joint ownership or had the titles held in trust for the children.

My advice to couples is to have the properties registered under joint ownership, as it would automatically pass to the surviving spouse as laid out in the Land Act 2012. If one is deceased or has the property held in trust by a spouse in trust for the children, it cannot be transferred or sold unless the court issues a vesting order, on condition that the proposed investments or funds acquired will be used in the interest of the children.”

To protect yourself and your children from a spouse who mismanages finances, Muthoni advises, “Keep some investments, savings and assets away from him and register them in your name or as held in trust for your children. For all matrimonial property such as the family home, cars, and family land, I will propose holding them as joint proprietors.

That way we protect both our interests and those of our children.” Dr Destaings Nyenyi Nyongesa is an economist and policy analyst.

He says, “The rule of thumb in effective financial management by a couple is open communication or transparency on financial goals and concerns. “Set joint goals. Identify and agree on short-term and long-term goals such as buying a house, saving, or planning vacations.

Divide financial responsibilities based on each person’s strength and preference and create a budget that outlines incomes, expenses, savings and investments. Ensure that both partners contribute to retirement, and always keep an emergency fund to cover unexpected expenses.

Lastly, normalise having regular reviews of the financial situation and adjust your budgets as needed to stay on track with your goals.”

Dr Nyongesa adds that protecting oneself from a spouse's financial mismanagement involves a combination of legal safeguards, transparent communication, and proactive financial planning.

“Separate Accounts to ensure each partner retains control over their personal finances, even as you maintain other joint accounts for shared expenses. Secondly, establish clear agreements on how joint finances will be managed. This includes rules for spending, saving, and investing.”

The financial expert advices partners in marriage to make a habit of monitoring joint accounts so that they can stay aware of all transactions and detect any unusual or unauthorised activities early.

“Document everything, and keep detailed records of financial agreements, transactions, and communications,” he says.

Regarding power of attorney, Dr Nyongesa says that couples should be cautious about enabling one spouse to act on the other’s behalf, and if it is necessary, then the scope and duration of such powers should be limited to specific tasks or time frames.

“Consult a financial advisor to create a financial plan that includes safeguards against potential mismanagement. Also, consider purchasing insurance policies such as liability or legal insurance that can provide financial protection in case of disputes or legal issues,” he says.