Premium

Winners and losers in Yatani's new tax measures

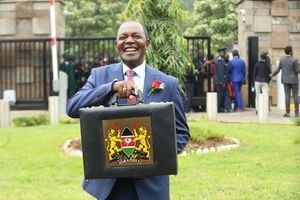

Treasury Cabinet Secretary Ukur Yatani pose for a photo with the budget briefcase at The Treasury before leaving for Parliament Buildings for the reading of 2021/2022 annual budget on June 10, 2021.

What you need to know:

- Exporters of goods will incur less costs to transport their goods from Kenya to other countries after transportation of exports was zero-rated.

- Products containing nicotine meant for inhalation and nicotine substitutes have been subjected to a charge of Sh1200 per kilogram.

The Kenya Revenue Authority (KRA) has entered the second week of implementing new tax measures following the enactment of the Finance Act, 2021, which has raised fresh concerns over the rising cost of living at a time the increase in the price of goods has hit a 16-month high.

The National Treasury has targeted several sectors that will play a key role in raising the new tax revenue to finance the Sh3.6 trillion budget for the current financial year, and has at the same time introduced tax incentives in other sectors to boost investment and stimulate consumption in a tough balancing act, which has birthed winners and losers.

Winners

Employers offering internships to technical college students

Employers who offer internships to at least 10 students from technical or vocational training colleges will from January next year qualify for tax rebates amounting to 50 per cent of their salaries in the year following the interning of the students.

The tax incentive is part of the government’s plan to encourage employers to take in more graduates from technical institutions, which have emerged as key pillars in creating new jobs especially in the informal sector, as opposed to giving rebates for interning university graduates only.

Kenya Power, oil companies

Businesses like Kenya Power and oil marketing companies (OMCs), whose retail prices are set by the government, will be exempted if the enforcement of the minimum tax is given the nod.

The implementation of the tax by the KRA was temporarily suspended by the High Court in April pending the determination of a myriad of cases filed by various parties protesting against the tax.

Insurers, investors in Special Economic Zones (SEZs), distributors whose income is wholly based on commission, and manufacturers who will have spent at least Sh10 billion in the four years preceding the date when the tax is enforced will also be spared from paying the tax.

Maize millers, goods exporters

Exporters of goods will incur less costs to transport their goods from Kenya to other countries after transportation of exports was zero-rated, which means they will no longer be paying the 16 per cent Value Added Tax (VAT).

Millers are also an elated lot after the supply of maize, wheat and cassava flour was zero-rated as opposed to being exempt, which will now allow them to claim input VAT to keep prices low and stimulate consumption.

Contributors to NHIF

Beginning January next year, workers who contribute monthly to the National Hospital Insurance Fund (NHIF) will get a 15 per cent relief on their contributions to the fund.

Individuals pay a maximum of Sh1,700 per month to the fund, meaning that they will get a relief of up to Sh255 in a bid to woo more Kenyans to join the scheme from where they will pay a mandatory contribution of at least Sh500 per month.

“The new provision will also lead to higher net pay for employees due to the insurance relief being applied on NHIF contributions deducted through the payroll,” tax experts at KPMG said.

Fitting your home with solar

It will also be cheaper to fit your home or company with a solar panel after the Act removed the requirement that this type of investment can only qualify for capital allowances. That is, if you supply electricity to the national grid.

This means that investors in the electricity sector who only want power for their own use, or supply it to a group of people, will qualify for these allowances on their equipment, machinery and buildings used in power production.

Currently, investors enjoy investment deduction equal to 100 per cent of this cost, and if 150 per cent of their value exceeds Sh200 million, or if the investment is based outside Nairobi.

“This is an additional incentive for private companies seeking to generate electricity for private use, or for direct sale to their customers without going through the national grid. It will encourage the growth of small renewable energy power plants, which is an important step towards increasing competition and reducing the cost of electricity,” they said.

Investors in SGR

Investors who will build 100,000 tonne-capacity bulk storage and handling facilities for goods before the end of next year to support the Standard Gauge Railway (SGR) operations will qualify for investment deduction of 150 per cent in a move to boost investment in warehousing.

Online businesses

Local businesses that provide their services online are breathing with a sigh of relief after they were exempted from paying the Digital Services Tax (DST), which was introduced last year to widen the tax base amid fierce resistance from businesses over its impact on their earnings.

The tax is now only being charged on foreign businesses conducting their online operations in Kenya.

Investors in mining and extractives

Beginning next year, investors in the mining and extractives sector will qualify for allowances on their capital expenditure on acquiring machinery even if they have not yet been given a mining right, which is set to stimulate investment in the sector.

These investors will also enjoy a cap on the interest rates charged by lenders on loans, which will see more investment in the sector on lower debt financing obligations.

Losers

Banks

Lenders, who are currently grappling with record-setting levels of bad debt, have been hit further by the introduction of excise duty on fees and commissions earned on loans, which will further thin their bottom lines.

This will increase the cost of accessing loans as lenders will pass the additional cost to borrowers.

Internet and telephone service providers

The Act has increased the excise duty on the Internet and telephone services from 15 per cent to 20 per cent, which has raised the cost of airtime and loans. It’s set to cut the earnings of internet, mobile loan providers and telcos on reduced consumption.

Jewelers, smokers, furniture, pasta, eggs, potatoes and onion consumers

Jewelers have been slapped with a 10 per cent excise duty, while products containing nicotine meant for inhalation and nicotine substitutes have been subjected to a charge of Sh1200 per kilogram.

Meanwhile, imported pasta, whether prepared or unprepared, has been slapped with a 20 per cent excise duty, while imported furniture, eggs, potatoes and onions have also been subjected to a 25 per cent excise duty.

Gamblers

The Act has reintroduced excise duty on betting and gaming at a rate of 7.5 per cent of the amount staked, which will deter gamblers from placing stakes. The tax was initially introduced in 2019 and saw several betting firms pull out of the local market but was removed in July last year through the Finance Act, 2020.

Investors offering services abroad

Businesses based in Kenya that also provide services in other countries will not be eligible to claim input VAT on the services they export after the supply of exported services was changed from zero-rated to exempt.

This will increase their operational costs at a time firms are already faced with low earnings due to business loss.

Investors in mining and extractives

While investors in mining and extractives will enjoy capital allowances and caps on interests on their loan obligations, they will be hit by the increase in withholding tax on fees they pay for foreign individuals and entities for their services from 5.6 per cent to 10 per cent.

This will hit the businesses hard by raising their operational costs, especially as most import their services.