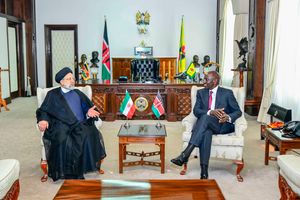

President William Ruto speaking at Parliament on November 9, 2023, during the State of the Nation address. PHOTO | DENNIS ONSONGO | NMG

|Business

Premium

Kenya calms markets with Sh45bn early Eurobond repayment

Kenya will pay back part of the $2 billion (Sh303 billion) Eurobond next month as it moves to calm a global financial market that has been jittery over the country’s ability to meet its obligations next June.

In his State of the Nation address to the joint sitting of Parliament on Thursday, President William Ruto revealed that the country will pay its first instalment of the Eurobond amounting to $300 million (Sh45.46 billion) by December, six months ahead of the due date.

“Our efforts to stabilise the situation have yielded such progress that next month, in December, we will be able to settle the first $300 million instalment of the $2 billion Eurobond debt that falls due next year,” said Dr Ruto.

“I can now state with confidence that we will and shall pay the debt that has become a source of much concern to citizens, markets and partners,” added the President in his second State of the Nation address.

Churchill Ogutu, an economist at IC Asset Managers (Mauritius), described the payment the President was talking about as a “buyback.”

Company or country bond buybacks can repurchase debt through tender offers to bondholders, enabling them to retire some or all of the securities ahead of due dates.

Kenya was expected to make a bullet payment of $2 billion in June next year, a huge obligation that the country could only meet by refinancing through another loan to retire the one that is maturing.

“Actually, I'm surprised as to how low the amount GoK (Government of Kenya) wants to buy back. I had pencilled in a much larger proportion (50 percent), as initially guided by the President mid this year,” said Mr Ogutu.

In June, President Ruto told Bloomberg TV that Kenya would repurchase at least half of its $2 billion Eurobond that’s maturing in June 2024 before the end of this year.

“The people who are looking to make a killing from this, they think they can scare us and create a narrative around it,” said Dr Ruto, adding the remaining half would be squared before the maturity date.

“We are in a good space.”

A tight global financial market aggravated by the hiking of interest rates by the central banks in advanced economies has dimmed the prospects of Kenya raising much-needed dollars to refinance the 2014 Eurobond, with some analysts fearing that Kenya might follow Ghana’s route in defaulting.

Last month, CBK Governor Kamau Thugge revealed talks with the Trade & Development Bank and the African Export-Import Bank aimed at raising between $500 million (Sh74.64 billion) and $1 billion in commercial loans before the end of the year.

Repurchasing the bond before maturity will allow Kenya to get a favourable price.

Overseas investors lowered their risk assessment after the CBK outlined a plan to borrow up to $1 billion to partly repay the maturing Eurobond.

“In the international market, yields on Kenya’s Eurobonds declined by an average of 89.18 basis points, with the 2024 maturity declining by 111.50 basis points,” said CBK in its weekly bulletin for November 3, 2023.

The falling yield on the Eurobond signals a declining risk appetite investors are assigning to Kenya’s ability to repay its debt.

Concerns raised by the credit rating agencies -- Moody's and Fitch lately – that a buyback of 50 percent bond amounts to a technical default could be the reason that the Government has now opted to consider a much lower quantum, reckoned Mr Ogutu.

“As the $300m figure represents 15 percent of the $2bn outstanding, what this tells me is that GoK can do the buyback via open market purchases,” said Mr Ogutu, noting that with this route, GoK discreetly buys back the Eurobond as a market participant.

“But this means they can do a maximum of 10% ($200m) and not the $300m. If an open market purchase is pursued, then it was premature for GoK to announce the buyback.”

Kenya first issued its Eurobond in 2014, targeting American and European investors, and raised $2 billion.

The cash raised from the issue was to be used for repayment of a $600 million syndicated loan as well as other infrastructure projects.

Since then, Kenya has been hooked to the Eurobonds and has occasionally returned to the global financial markets to either refinance a maturing loan or plug its budget deficit.

Eurobonds, a type of commercial loan, have, however, increased the country’s debt distress due to their high-interest rates and short tenors.

“We have worked hard, at home and further abroad, to mobilise a broad coalition of bilateral development partners, multilateral development banks and other agencies, which have rallied to pull our country back from the brink of debt distress and set us firmly on the path towards sustainable economic growth,” said Dr Ruto.