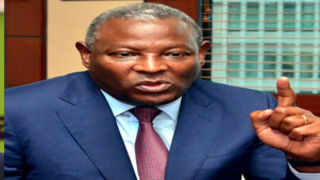

Kenya Commercial Bank Group Chief Executive Officer Joshua Oigara and his Equity Group counterpart James Mwangi.

|Finance and Markets

Premium

How James Mwangi has steered Equity to storm top banking hierarchy

James Mwangi is not known to be modest. If there is one thing the Equity Bank boss has beaten his fierce rivals in the banking sector in , then it is his irresistible sales tongue.

He is the salesman extraordinaire that any bank would want on their side. If you give him a minute to sell you his dream, he would take five. The career banker, known in the banking circles as King James, never lets a chance to push his brand slip by without boasting about how profitable the banking empire he has built has become.

The only difference today is that when he does it, the numbers are also on his side.

The man who has for decades bestrode Equity Bank like a colossus is now eating the lunch of his peers, after overthrowing KCB in the supremacy battle for Kenya’s most profitable bank, and now the most resilient in a pandemic year. The two have also since exported their rivalry to the regional markets after intensifying their acquisition of banks here at home and abroad.

For a long time, his detractors have always questioned the bank’s ability to weather a storm, and the Covid-19 pandemic appears to have vindicated him, according to the latest numbers in the banking sector.

An analysis of the quarter one results shows that Equity has overthrown KCB on various fronts from profitability to asset size.

Sh6.2 billion profits

Before Covid-19 pandemic struck, KCB was far ahead of Equity in the first three months of the year, after it posted net profits of Sh6.2 billion, compared to Equity Bank’s Sh5.3 billion. Cooperative Bank came in third with Sh3.5 billion, then Stanchart (Sh2 billion) which was followed closely by Absa Bank at Sh1.9 billion.

But a year down the line, the chart has changed with Equity perched at the top in profitability after reporting net profits of Sh8.7 billion, a 63 percent jump from where it was in March last year. KCB came in second with Sh6.3 billion, and Cooperative Bank remained third with Sh3.4 billion, having reported a marginal decline.

But it is NCBA, the new kid on the block that is promising to give the top three banks a run for their money after completing its rebrand. By March this year, the bank associated with the Kenyatta family is now the fourth most profitable bank after overtaking Absa, StanChart and NIC Banks.

From number eight last year, NCBA has pulled fast ahead, overtaking the big boys who have remained in the top spots for over a decade, boosted by its acquisition of NIC bank.

The quarter one results show that the bank earned Sh2.8 billion in profits after tax, compared to Sh1.6 billion a year earlier. That translates to a 73 percent growth. If it maintains that pace, it will catch up with Cooperative in under a year.

Loans grew

Equity is also doing better in terms of the health of its loan book. The first quarter shows that while its bad loans grew to Sh63.4 billion, its main rival booked Sh98 billion in gross non-performing loans. Dr Mwangi is also spending less on his staff but generating more profits from them than Mr Oigara.

In the quarter, employee costs for Equity bank stood at Sh4 billion compared to KCB’s Sh6 billion, which shows that Mr Oigara is paying his employees comparatively better than Mr Mwangi.

Equity has also retained the bragging rights for being the only bank with an asset size above Sh1 trillion mark as at the end of March 2021, after it reported a total asset base of Sh1.06 trillion compared to KCB’s 977 billion.

“Our strategy; purpose-first, inclusivity, affordability, reach, agility and quality have proven resilient and sustainable,” said Dr Mwangi said last week as he released the first quarter of 2021 financial results..

But Dr Mwangi is not sitting pretty. His fiercest rival is not letting him perch at the top easy. As he makes one move, Mr Oigara, has always had a counter move up his sleeve.

KCB continued to beat Equity Bank on interest income, which is the core revenue for commercial banks. In the first three months of the year, KCB made Sh21.9 billion, compared to Equity Bank’s Sh20.3 billion. Mr Oigara was also ahead of Equity in interest earned from customer loans, having made Sh15.8 billion compared to Equity’s Sh14.1 billion. It was the same story on income made from government securities with KCB making Sh5.9 billion and Equity coming a close second with Sh5.8 billion. KCB also had a bigger loan book at Sh597 billion compared to Equity’s Sh487 billion.

The two lenders, who have defined the competition in Kenya’s banking sector, have exported their rivalry into the East African market in the rat race to be the region’s most profitable banks.

Mass-market lender

Though the two lenders deployed two different strategies that elevated them to the top spot, they are now neck to neck, checkmating one another in every move at home and abroad.

Dr Mwangi built his bank as a mass-market lender initially targeting the bottom of the market pyramid, but he has now rebranded and is playing in the league initially controlled by Absa Bank, which rebranded from Barclays Bank, as well as Standard Chartered banks.

“The pandemic tested our resilience, but the Group maintained the balance sheet growth momentum it has built for over a decade. This growth was recorded across all the businesses and translated to all the subsidiaries returning a profit for the year,” said KCB Group CEO Joshua Oigara.

KCB, which benefited from State business, has struggled to shake off the government tag to operate like any other private entity, which has seen it expand its footprint in the region.

Last week, its shareholders finally approved its bid to buy Tanzanian and Rwandan banks as it moves to increase its regional footprint. The bank will now acquire up to 100 percent of the issued ordinary shares in Banque Populaire Du Rwanda (BPR) and a 100 per cent stake in African Banking Corporation Tanzania Limited (BancABC), both pending final approval by regulators.

“These acquisitions will reinforce the Group’s leadership position and give us a stronger edge to play a bigger role in driving the financial inclusion agenda in the East African region while building a robust and financially sustainable and profitable organization for the shareholders,” said KCB Group Chairman Andrew Kairu.

As Dr Mwangi denies his shareholders dividends, Mr Oigara is more generous, preferring to keep the dividends flowing despite the pandemic.

“We have adopted a two-pronged strategy of being offensive and defensive. We strengthened our capital buffers by retaining profits and withholding dividend payouts, took long-term loan facilities that strengthened our liquidity buffers,” Dr Mwangi said.

KCB’s shareholders last week approved a first and final dividend of Sh1 per share worth Sh3.2 billion to be paid to investors by June 26 as Equity denied its shareholders dividends for a second year in a row.

“As the economy continues to reopen, we are strengthening our balance sheet to give us room to support our customers and stakeholders through the crisis while ring-fencing the business for the post-pandemic growth,” said Mr Oigara.

KCB’s latest acquisitions will expand its existing portfolio in Rwanda and Tanzania, while it also has operations in Uganda, Burundi and South Sudan, and received approval by regulators to enter Ethiopia late last year. On its part, Equity is present in six countries and a commercial representative office in Ethiopia.