'I earn over Sh100,000 but I am drowning in loans after losing almost Sh1m in a scam'

I earn over Sh100, 000 but I’m drowning in loans.

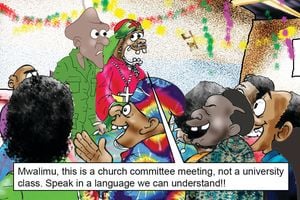

My name is Mark. I work in an academic institution and I have a net income of Sh110,000 after PAYE (65,000), Sacco deposit (4,000) and Sacco loan repayments (8,000), NSSF (1,080), NHIF (1,700), housing levy (3,671), and bank loan deductions (49,000).

I have Sacco deposits of Sh215,000 but I have taken Sacco loans totaling Sh166,000 where I pay the Sh8,000 monthly.

I took a bank loan of Sh800,000 to purchase some land last year, but it later turned out to be a scam and I lost that money.

I am servicing that loan at Sh49,000 per month (loan balance at Sh580,135 today with 14 months left on the tenor).

This leaves me with a net income of Sh110,000.

My expenses are as follows: Rent Sh30,000, food shopping and house expenses Sh17,000, Wi-Fi, electricity and water Sh8,000.

I also took a Sh200,000 credit card and I have used Sh198,000 on it and I pay Sh9,000 monthly. I also have soft loans totaling Sh229,000 and I pay on average Sh92,486 monthly (I pay them and take the loan again immediately).

I acknowledge that I am in a financial mess, but I want to come out and build a healthy financial plan as I am 35 years old. I do not have any MMF or other savings whatsoever. How can I get out of this hole?

Dominic Karanja is a financial and investments consultant

To address your current financial situation effectively, you need to exercise patience, discipline, and be prepared to make tough decisions. With a basic monthly salary of approximately Sh245,000, your take-home pay after statutory deductions amounts to roughly Sh177,000.

However you have a deficit of around Sh46,000 because your living expenses and loan repayments are higher than your income. Based on the expenses you have listed, it seems you may have overlooked items such as transport costs, personal care and entertainment.

To manage your finances efficiently and achieve your financial goals, start by creating a detailed financial plan and a budget. Budgeting plays a crucial role in effectively managing your personal finances and realising your financial aspirations.

You need to develop a detailed budget that outlines all your monthly income and expenses including debt repayments, living expenses, and any discretionary spending.

Monitor your spending habits and identify non-essential expenses that can be minimised or eliminated. Prioritise the establishment of an emergency fund, aiming to cover at least six months’ worth of your living expenses.

Begin by allocating a portion of your monthly income to build a financial safety net, which can provide a buffer for unexpected expenses and emergencies. Given your current living expenses, it is advisable to create an emergency fund totaling at least Sh330,000, and I suggest you consider investing this fund in a Money Market Fund.

While it’s recommended that you commit at least 20 per cent of your income to savings and investments, you are currently saving only two per cent of your net monthly income in a Sacco. Purpose to commit at least Sh35,000 per month towards savings and investment.

I would like to encourage you to increase the amount you are saving in the Sacco and always remember to capitalise your Sacco dividends to deposits to help increase your borrowing power and earn high dividends in the subsequent years.

Retirement savings should be part of your financial goals because pension saving will assure you a good life after retirement, and it will also offer you some tax benefits. Explore side hustles and passive income sources to augment your earnings.

It is important that you develop a plan on how to manage and reduce your debts. I would recommend that you apply the debt avalanche method, wherein you make minimum payments on all debts and allocate any remaining funds towards settling the debt with the highest interest rate.

It is prudent to prioritise debts with the highest interest rates for repayment initially, typically focusing on credit cards and soft loans. Responsible borrowing entails only taking loans that ultimately contribute positively to your financial well-being.

It is crucial to understand the interest rates, repayment terms, and total outstanding balances for all your debts. It is recommended that you commit at least a third of your net income towards loan repayments, implying that you should currently be committing at least Sh59,000 toward loan repayments, but your current monthly loan repayments amount to Sh158,486.

Sacco loans are cheaper than bank loans and I would urge you to consider consolidating your current bank and Sacco loans to streamline your debt obligations into a single, long-term Sacco loan with manageable installments.

The combined outstanding balances of both loans total approximately Sh750,000 and to access a loan of that amount from the Sacco, you must have saved around Sh250,000, given that Sacco typically grant loans three times your savings.

However, your current savings fall short by approximately Sh35,000. To boost your Sacco savings so that you can qualify for the loan you should consider capitalising your Sacco dividends to deposits. A Sh750,000 Sacco loan payable over three years at reducing balance interest rate of 12 per cent will attract a monthly installment of approximately Sh25,000.

With the combined installments of your current bank loan and Sacco loan amounting to Sh57,000, you would have an additional Sh32,000 available, which could be directed towards clearing your soft loans.

Avoid taking new loans and credit card debt while you are paying off your existing debts. Stay dedicated to your budget, debt repayment plan, and savings objectives.

Once you’ve made headway in repaying your debts, refrain from acquiring consumption loans unless it’s unavoidable. Seek guidance from a financial advisor who can offer tailored advice suited to your circumstances.

Invest time in financial education to enhance your understanding of money management, investing, and saving strategies.