Public participation pays off

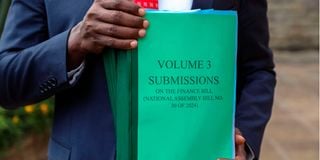

Chairperson of the National Assembly Finance and National Planning Committee, Kimani Kuria, displays a copy of Finance Bill 2024 at Parliament Buildings Nairobi on June 18, 2024.

What you need to know:

- Changes will help to make the heavy tax burden a bit more manageable.

- Kudos to the Finance committee for heeding to the desperate cry of Kenyans.

It is refreshing to see that our constitutional right to voice our opinions through public participation has borne fruit. I am delighted to see that the members of the National Assembly’s Finance committee and our President have chosen to listen to the voice of the people.

This was evident during the press briefing held at State House on Tuesday afternoon where Finance committee chairperson Kimani Kuria declared that the government has agreed to keep bread zero-rated, retain excise duty on financial transactions at 15 per cent, remove the proposed Motor Vehicle Tax and retain the Eco Levy only on imported finished goods.

Economically, the removal of the Motor Vehicle Tax means that the distribution of goods and services countrywide will continue uninterrupted and our average GDP growth rate will therefore remain steady.

Promoting financial inclusion

With regard to the finance sector, the removal of the proposed increase in excise duty on transactions means that the volume of mobile money transactions will remain high, thereby promoting financial inclusion in the country.

The imposition of the Eco Levy on imported finished goods means that prices of imported products will be higher, thus encouraging Kenyans to purchase locally manufactured goods. This will boost local manufacturing.

I think it’s safe to say that citizens who were waiting to see the changes proposed by the committee with baited breath can now sigh with relief.

Regressive taxation policies

The changes will help to make the already heavy tax burden on the common taxpayer a bit more manageable. Kudos to the Finance committee for adhering to the public participation requirement and heeding to the desperate cry of Kenyans.

By exercising our democratic right to engage in public participation, we have managed to stop the enactment of what would have been economically regressive taxation policies.

I ask all of us Kenyans to continue exercising our civic duty and make our voices heard through the ballot in 2027.

Mr Kibathi is an accounting intern. [email protected]