Parliament summons ex-NBK boss over Sh7.7m Moi University fees fraud

The entrance to Moi University's main campus in Kesses, Uasin Gishu County on February 8, 2024.

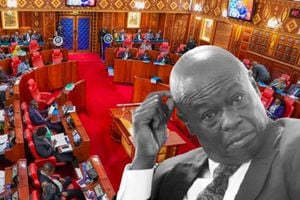

Parliament has summoned former National Bank of Kenya (NBK) Managing Director Wilfred Musau after it emerged that the lenders’ staff colluded with Moi University officials to defraud the institution Sh7.7 million in student fees.

The National Assembly’s Committee on Public Investment Committee on Education and Governance wants Mr Musau to explain why cheques meant for student tuition account were irregularly banked in the Moi University staff welfare account and subsequently withdrawn.

On Wednesday, the committee heard that whereas an officer who worked at Moi University accounts department was arrested, charged and released on a Sh2 million bail, the NBK merely subjected two tellers who accepted the cheques into the welfare account to disciplinary action.

The MPs heard that the main suspect in the criminal matter had been released on bail and the case withdrawn under section 87(A) of the Criminal Procedure Code.

The matter was withdrawn after the suspect jumped bail and is currently at large despite a warrant of arrest having been issued.

Mr Musau, appointed in October 2016 for a five-year period, was the biggest victim in the executive shake-up that followed the takeover of NBK by the Kenya Commercial Bank (KCB) in 2019.

The committee heard that the NBK refunded Moi University Sh7,727,190 on March 5, 2020 after the university demanded refunds and threatened to institute legal proceedings.

Moi University Vice Chancellor Isaac Kosgey told MPs that the fraud was committed between May 30, 2018 and December 31, 2018.

He said the institution issued a notice to NBK on February 5, 2020 demanding refunds of the stolen money and the bank decided to reverse the same following a threat of legal action.

The committee took the decision to summon Mr Musau after George Odhiambo, the current NBK Managing Director, failed to provide satisfactory explanation given that he was not working for the bank when the fraud took place.

“We understand that you (Mr Odhiambo) was not in office at the time this fraud took place. I direct that summonses be issued for the former Managing Director to appear so that we get proper answers as to why nobody from the bank has been charged,” Jack Wamboka, who chairs the committee ruled.

“We want to apportion responsibility as to why fraudulent bank and the university officials are still at large and have not been charged with the theft of Sh7.7 million of student fees.”

Mr Odhiambo told the MPs that it is clear that the fraud was perpetuated by the Moi University staff who was arrested through the assistance of the bank and arraigned before court, a claim the Prof Kosgey dismissed arguing the lender had the responsibility to protect clients’ money.

Lost money

“I confirm that the bank lost money but the bank resolved to refund the university on a business relationship basis the whole amount of Sh7,727,190 on May 5, 2020. We accepted liability for the loss,” Mr Odhiambo said.

Prof Kosgey informed lawmakers that the university detected the fraud following huge outstanding cheque stock was noted and decided to report the anomaly to the banking fraud unit.

“We got a lot of frustration from the National Bank's former Managing Director. The NBK later visited us at Moi University on August 18, 2019 for discussions but we decided to report the matter to investigative agencies and we listed all the 65 cheques that had been used to commit fraud. We also reported five staff we suspected,” Prof Kosgey said.

“We also told the bank that it was their responsibility to take care of our money. They had wanted us to share the loss with them but we refused.”

Auditor-General Nancy Gathungu has flagged the irregular banking of student fees into a welfare account in the audit of Moi University books of accounts for the financial years 2018/19 to 2020/21.

Ms Gathungu said examination of bank statements, cash books and ledgers for students, provided for audit, revealed that the reported cash and cash equivalents balance of Sh920 million excluded cheque payable to Moi University received in the Nairobi Campus totaling Sh7.7,727,190 which were not banked in the university’s bank account but were instead irregularly banked in the Moi University Staff Welfare account.