US Trade Representative Katherine Tai addressing journalists at Serena Hotel, Nairobi on July 19, 2023. FILE PHOTO | LUCY WANJIRU | NMG

US firms are losing out on big contracts in Kenya due to bribe requests and extortion from top government officials in what has tilted scales in favour of foreign contractors willing to pay to secure tenders, the American government says in a new report.

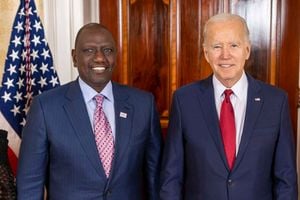

The US has also flagged political interference in Kenya’s judiciary and extortion in public contracts, warning that the vices pose a barrier to investment inflows even as the two countries negotiated new trade and financing deals with President William Ruto’s government.

“Corruption remains a substantial barrier to doing business in Kenya. US firms continue to report challenges competing against foreign firms that are willing to ignore legal standards or engage in bribery and other forms of corruption,” US Trade Representative Katherine Tai said in the report.

A review by the Office of the United States Trade Representative (USTR) notes that despite years of governance, procurement, and judicial reforms to enhance efficiency and grow public confidence, corruption remains entrenched in some pockets of the Kenyan judiciary and government.

Ms Tai said this has undermined investor confidence even as authorities, both at the national and county levels, continue to directly ask for bribes from investors seeking government deals and other approvals.

The report does not name any foreign contractors but a recent analysis by the nation shows that Chinese contractors win the bulk of big-ticket contracts in Kenya.

“Corruption is widely reported to affect government procurements at the national and county levels. Kenya has not effectively implemented its anti-corruption laws. US firms routinely report direct requests for bribes from all levels of the Kenyan Government,” she added.

The US said that despite efforts to increase efficiency and public confidence in the Kenyan judiciary, the backlog of cases and corruption undermine the judicial system’s credibility and effectiveness.

“While judicial reforms are moving forward, bribes, extortion, and political considerations continue to influence court cases. As such, foreign and local investors risk lengthy and costly legal procedures,” Ms Tai said.

The US’ claims of graft and political interference come on the back of the judiciary battling reports of bribery and growing dalliance with Dr Ruto’s administration.

The suspicions of a growing bond between the two arms of government have been taking root since the January 22 meeting between Dr Ruto and Chief Justice Martha Koome at State House. These talks were also attended by the speakers of the National Assembly and Senate.

The Judiciary was, for example, forced to defend itself on March 21 against sentiments by the President five days earlier that appeared to indicate that the Ruto administration had struck a deal with the judiciary over the implementation of the controversial housing levy.

The enforcement of the levy at the rate of 1.5 percent of a worker’s gross income, matched by the employer, has been challenged in court on allegations of being inconsistent with the Constitution even after lawmakers passed the primary legislation for its rollout.

The levy is a gross-on-gross taxation on incomes where the Kenya Revenue Authority uses the same gross to also calculate the Pay As You Earn, thus a form of double taxation.

“Judiciary is not, in any capacity, able to enter into any agreement with the Executive, especially in a matter that is before court. The Judiciary was not a party in that cause,” Justice Koome said.

Washington has included an anti-corruption clause in its ongoing negotiations with Nairobi over a planned bilateral trade deal to be used as a benchmark for similar deals with African countries post-African Growth and Opportunity Act (Agoa).

“The text mandates procedures for the removal of public officials who are charged with or convicted of corruption, along with measures to prevent opportunities for corruption by members of the judiciary,” reads the summary of US proposals to Strategic Trade and Investment Partnership (STIP).

“To prevent the hiding of ill-gotten gains, the text also includes a provision requiring the maintenance of a central register for companies to report beneficial ownership information.”

Corruption is seen as the “biggest industry” in Kenya, gulping about a third of the annual budget (projected at about Sh3.9 trillion this financial year), according to an estimation by former Ethics and Anti-Corruption Commission chairperson Philip Kinisu in March 2016.

“Despite efforts to increase efficiency and public confidence in the judiciary, the backlog of cases and continued corruption undermine the judicial system’s credibility and effectiveness,” Ms Tai wrote in the NTE report.

“US firms routinely report direct requests for bribes from all levels of the Kenyan Government.”

The report suggests that deep-rooted corruption and lengthy judicial processes in Kenya are turning potential investors away.

Kenya has struggled to sustainably grow foreign direct investment (FDI) despite marketing herself as the financial hub of Africa with a modern telecoms and transportation infrastructure

FDI flows into Kenya ended a five-year slide in 2022 on increased deals in renewable energy, but still trailed regional peers such as Ethiopia, Tanzania, and Uganda, according to an annual survey by a United Nations agency.

The UN Conference on Trade and Development (UNCTAD) in its World Investment Report 2022 estimates the FDI flow into Kenya hit $759 million (about Sh100.18 billion under the prevailing conversion dollar rate of Sh132 per unit) from $463 million in 2021.

The 63.93 percent jump in FDI inflows was the first expansion since 2017 when the flows rose 23.27 percent to $1.4 billion (Sh183.68 billion), according to UNCTAD analysis.

The FDIs had been on a downward trend for four years in a row through 2021 when they hit the lowest levels since $259 million (Sh33.95 billion) in 2012.