The Kenyan government plans to spend Sh220 billion in the next five years to set up new iron and steel plants in a move that is likely to rattle private sector players in an industry that is under the tight grip of a dozen tycoons.

The investment, revealed in the government’s Sh16 trillion fourth medium-term plan (MTP IV) released at a ceremony presided over by President William Ruto last week, is being fronted as part of the government’s efforts to increase local production of the key metals at a time the State is going big on construction of affordable houses.

According to the plan, the government will set aside Sh60 billion in the coming fiscal year which starts in July 2024 for the integrated iron and steel plant.

The project will be implemented by the Numerical Machining Complex (NMC) -a parastatal under the Ministry of Industry, Trade and Cooperatives -- in conjunction with the Ministry of Mining, and the private sector.

NMC, a mechanical engineering company, is owned by Kenya Railways, which has 51 per cent shares, and Kenya Shipyard Limited, which holds 49 per cent shares in trust of the government.

For the 2024/25 and 2025/26 fiscal years, the project will be allocated another Sh50 billion each as the country moves to wean itself from the import of iron. This will reduce to Sh20 billion in the 2026/27 financial year before being doubled to Sh40 billion in 2027/ 2028 when implementation of the MTP IV ends.

The source of the funds, the report notes, will be the government. Government funds can either be in the form of taxes or loans.

“The project targets to promote the establishment of modern integrated iron and steel mill plants for the production of high-grade steel for use by industries, including construction and automotive, promoting the exploitation of locally available raw materials and attracting manufacturing industries,” James Muhatia, the Principal Secretary for Economic Planning said in a brief without providing details of the Sh220billion planned investment.

The plant also targets promoting mineral recycling, processing, and value addition.

“The establishment of integrated iron and steel mill plants will provide opportunities to use locally available scrap metal. This will be achieved through the development of policies and regulations, awareness creation, and capacity building of key stakeholders in the industry,” says the MTP IV report.

The steel industry in Kenya is currently controlled by about 20 firms, including Devki Group, Tonoka Group, Tarmal Steel, Bachu Industries, Insteel, Apex Steel, Steel Structures Limited, Jumbo Steel Mills, Eldoret Steel Mills and Abyssinia Iron and Steel Limited.

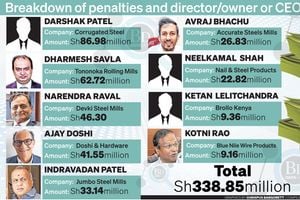

Players in the sector are currently fighting claims of price fixing and causing artificial shortages of key construction materials that saw them fined Sh338 million by the Competition Authority of Kenya (CAK) last year.

It is not clear whether the State will partner with the existing steel producers or bring in new rival private sector firms for the steel milling project.

Under the Bottom-Up Economic Transformation Agenda, the Ruto administration wants to boost the local production of iron and steel in what is aimed at creating jobs and foreign exchange reserves by cutting on imports of iron ore.

Beginning in the financial year 2018/19, Kenya increased import duty on finished iron and steel from the 25 percent levied by the other five East African Community member states to 35 percent, noting that the industry was facing stiff competition from “imported subsidised iron and steel products.”

In the Finance Act 2023, the government introduced an export and investment levy of 17.5 percent on imported iron and steel, pushing up the effective tax on imported billets, a raw material for the manufacture of steel, to 31.5 percent from 3.0 percent before.

Manufacturers, through their lobby, have since filed a court case seeking to block the new 17.5 percent export and investment promotion levy, which also applies to imported clinker, a raw material for the manufacture of cement. The Kenya Association of Manufacturers (KMA) says the levy does not achieve its intended goal, thus they want it declared unconstitutional.

The effective rate includes a 10 percent import duty on billets introduced in the Finance Act 2023. Taxes on imported billets include a 2.5 percent import declaration form and a 1.5 percent railway development levy.

In 2022, Kenya imported 1.4 million tonnes of iron and steel valued at Sh150.6 billion, official data shows.