GRAPHIC | GENNEVIEVE AWINO | NMG

|Business

Premium

How new January taxes will hit firms, consumers

The implementation of the controversial Finance Act 2023 enters its third phase this month, with the government seeking improved income tax compliance by businesses and landlords.

The tax measures that came into effect on January 1 are mostly aimed at ensuring tax compliance and might not be as painful as those enforced from July/September 2023 that have rattled consumers.

Robert Waruiru, a Partner in charge of Tax & Regulatory at Ichiban Tax & Business Advisory, sees the new tax measures as an attempt at broadening the tax base, ensuring that everyone pays their fair share.

Businesses that have been fiddling with their expenses when filing for corporate income tax (CIT) might find it challenging. In the year to last October, income tax recorded a shortfall of Sh48.8 billion with the Kenya Revenue Authority (KRA) increasingly keen to hit its Sh1.2 trillion target by leveraging on the tax measures coming into effect this month, especially the requirement for businesses to produce electronic tax invoices.

Beginning this month, both resident and non-resident businesses with a permanent establishment in Kenya will be paying standard CIT of 30 percent on gross profit. Initially, the latter had been paying a CIT of 37.5 percent.

To claim an expense when filing for CIT, every business will be expected to produce an invoice generated from electronic tax invoicing management (e-Tims) to support the expense.

Those who do not produce an electronic invoice will not be able to claim such an expense, which means they will pay a higher CIT.

“Anything that comprises business income, the person needs to raise an electronic tax invoice,” said Hakamba Wangwe, the KRA chief manager for eTims. “Especially if you want to declare it as a business expense or to claim it as a business expense, you need an electronic tax invoice to support that expense.”

This is mandatory for a business entity, whether it is business-to-business (B2B) or business-to-consumer (B2C) in the case of utilities such as power distributors, telcos and supermarkets.

“If you are a buyer and you are a business entity, you need to support your expenditure with an electronic tax invoice. Of course, taking into consideration the exclusions that have been provided for by the law,” she added.

Failure to issue an electronic tax invoice attracts a fine not exceeding Sh1 million, or imprisonment not exceeding three years or both.

Onboarding for non-VAT registered taxpayers to the eTims platform will continue up to March 31, 2024 during which period penalties for failure to comply will not be imposed.

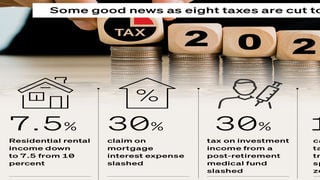

From this month, landlords have been offered a sweetener of paying a lower rental income tax rate of 7.5 percent down from 10 percent. “This is a good thing for landlords,” said Waruiru.

On the other hand, the KRA will be expecting full compliance as it has stepped up efforts to move into estates in search of land owners who are not paying rental income taxes.

Individuals will be allowed to claim mortgage interest expense to a maximum of Sh300,000 per year incurred on money borrowed from a co-operative society in what is aimed at encouraging home ownership through saccos.

Currently, tax resident persons are allowed to deduct interest paid up to Sh300,000 on a borrowing to purchase or improve residential premises.

Those who contribute for post-retirement medical funds will start enjoying a relief of 15 percent of contributions, capped at Sh60,000 annually, from Pay as you earn (PAYE).

“This provision will encourage individuals to take up post-retirement medical schemes to cater for medical costs in their post-employment years,” said KPMG in an advisory.

Employers paying club subscriptions and entrance fees for employees will be allowed to deduct them as expenses when filing for their CIT.

KPMG notes that the provision will incentivise companies to invest in the welfare of staff with the hope of carrying out business development through networking.

The advance tax on lorries, trucks and pick-ups from Sh1,500 per tonne or Sh2,400, whichever is higher, to Sh3,000 per tonne or Sh5,000, whichever is higher, will trigger higher charges in the logistics sector.

An advance tax, which is paid before a public service vehicle is registered, can, however, be claimed when paying for CIT. Other than the CIT, resident rental tax, advance tax and other income taxes that will be impacted by the measures coming into effect this month include Withholding Tax (WHT) and Capital Gains Tax (CGT).

Those tax measures touching on WHT and CGT are mostly aimed at either preventing capital from leaving the country or attracting it, a major headache for Kenya which has been losing its competitiveness in attracting foreign direct investment (FDI) to Uganda.

Non-resident businesses with a permanent establishment in the country will pay 15 percent on repatriated income in what is aimed at discouraging capital flight.

However, to encourage foreign firms to set up in Kenya, corporation tax for non-residents has been reduced from 37.5 percent.

To encourage vaccine manufacturing, royalties and interest paid to a non-resident, for example, a bank or parent company, by a firm producing the drug will be exempted from paying the 20 percent withholding tax.

Income earned by a foreign contractor and sub-contract for a project that is wholly financed through a grant will attract 30 percent corporation tax. Similarly, employees and consultants working on such projects will not have Paye obligations.

There is also a huge incentive for investments to flow into special economic zones (SEZs), with gains on transfer of property within the SEZ enterprise, developer or operator exempted from the 15 percent capital gains tax.

Moreover, royalties, interest, management, professional, training, consultancy, agency or contractual fees paid by a SEZ developer, operator or enterprise, in the first 10 years of the establishment to a non-resident person, shall be exempted from the 20 percent withholding tax.