Is the Chinese currency a viable global alternative to the US dollar?

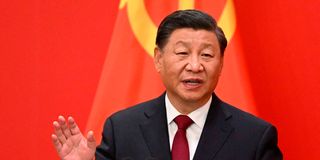

China's President Xi Jinping. In slightly over four decades, China has grown at a breakneck pace from a largely agrarian society to become the second-biggest economy in the world.

On March 20-22, Chinese President Xi Jinping paid a highly significant State visit to Russia.

During the visit, his host President Vladimir Putin made the remarkable pledge that Russia would use its influence to promote the use of the Chinese currency, the renminbi (or yuan), in its trade with other Asian countries, Latin America and Africa. Meanwhile, a full two-thirds of Russia’s and China’s brisk $215 billion bilateral commerce is currently being conducted in their national currencies, the Russian rouble and the yuan.

Come March 31, China and Brazil signed an agreement to the effect that they will be conducting their $150 billion mutual trade not with the US dollar, but with their respective currencies — the yuan and the Brazilian real. Already India, the world’s fifth largest economy, has been busy promoting its rupee currency in world markets.

She does much of her trading with Russia in roubles and rupees rather than dollars and euros. India is a leading buyer of Russian oil, as is China. They have both brushed off US pressure to support Western efforts to sanction Russian oil exports because of the war in Ukraine.

Other countries actively considering paying for their Chinese imports in yuan and thus reduce their reliance on the dollar are Argentina, Venezuela, Bolivia, Sri Lanka and Saudi Arabia. And the list keeps growing.

A recent pronouncement from the BRICS grouping (Brazil, Russia, India, China and South Africa) that they’ll be shifting from trading with the US dollar among themselves has become a hot talking point across the world. In America, analysts worry this could threaten the dollar’s position as the world’s reserve currency.

Elsewhere, especially in Asia, South America and Africa, there has been excitement that the de-dollarisation trend would mark the beginning of the end of the dollar’s pre-eminence in international trade and financial markets.

The excitement is premature. The dollar is not going anywhere anytime soon. Its hegemony is being tested but its grip remains firm. Eighty per cent of international financial transactions are in dollars. It’s also the reserve currency of necessity for central banks worldwide.

The five top reserve currencies in terms of their global dominance today are the US dollar (60 per cent), the Euro (20 per cent), the Japanese Yen (5.5 per cent) and the British Pound (4.8 per cent). The yuan is behind at 2.8 per cent.

Still, the dollar’s status as the world’s Number One currency has steadily eroded over the decades. This trend is undeniable. In 1999, the dollar accounted for 71 per cent of forex reserves held by the world's central banks.

Today the figure has dipped to 60 per cent and is still dropping. China’s yuan was nowhere a couple of decades ago. All the other hard currencies have been around longer. The yuan is now steadily moving up. That is the other trend.

Yuan turning tables

In the intermediate years, the euro could pose a bigger threat to the dollar’s supremacy. Yet nobody rules out the yuan turning the tables on the Western currencies someday. Consider this: in slightly over four decades, China has grown at a breakneck pace from a largely agrarian society to become the second-biggest economy in the world.

Last year, the Brics announced they were working on issuing their own currency. The creation of a Brics currency will be one of the main topics when the Brics countries meet for a planned summit in Johannesburg in August. The task will not be easy with countries that have quite different economic systems. The proposed currency can only be a long-term plan. It should be seen more as a statement of intent rather than a done deal.

Why the sudden campaign to de-dollarise? The push can be summed up in one word — Ukraine. The Ukraine war and the anti-Russia sanctions imposed by the West have accelerated the moves at de-dollarisation. There was the freezing of Russia’s $300 billion dollar assets by the West.

Then came the banning of Russian banks from using the mainly dollar-denominated SWIFT (Society for Worldwide Interbank Financial Telecommunications) system, which anchors global money transfers and payments. All those were warning triggers to other big trading countries. If the West can do that to Russia, the same fate can befall others who stray from America’s line. Hence the determination to de-dollarise, led by Russia and China.

Brics make up 41 per cent of the world’s population and account for 16 per cent of global trade. They contribute a quarter of global economic output in nominal GDP. However, in purchasing power parity terms (PPP), Brics is reckoned to contribute a combined 31.5 per cent of world GDP, compared to 30.7 per cent (in PPP) by the G7 industrialised countries.

Before thinking of an alternative currency, a preferred strategy by many non-Western trading blocs that seek de-dollarisation is for them to trade among themselves using their own currencies.

The yuan, because of China's huge economy and exports that span the six continents, is bound to start strong. China is not called “the world’s factory” for nothing. Still, the yuan has drawbacks vis-a-vis the dollar. One, China’s financial system is far less developed than America’s.

Two, because of capital controls, the yuan is not fully convertible. For the yuan to become a truly global currency, the Chinese authorities would have to let it float freely. That would mean losing tight control of their currency, which China is not ready to countenance.

The dollar gives America unrivalled economic and political muscle. It can slap sanctions on countries unilaterally, freezing them from large parts of the world economy. And as the world’s reserve currency, the dollar benefits from high demand, which allows the US to borrow at lower interest than other countries.

[email protected]; @GitauWarigi