Kenya’s economy – the sick man of East Africa?

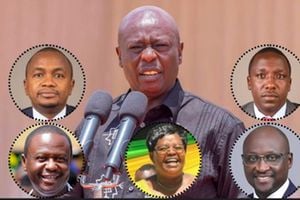

Treasury Cabinet Secretary John Mbadi

What you need to know:

- Kenya’s productive sector is compromised because infrastructure delivery has led to rapid borrowing and higher taxes.

- Borrowing has crowded out the private sector from the credit market, while high taxation has led to civil unrest.

The economic outlook for Africa is moderate growth of 3.8 per cent this year, improving to 4.2 per cent in 2025. Still slightly lower than Asia, Africa’s performance is buoyed by East Africa, where Ethiopia, Rwanda and DRC are growing at rates above 6 per cent. Some optimistic analysts predict the region’s growth to outpace Asia’s in the next decade.

On account of supply and demand, every economics story is two-sided - on the one hand, and then on the other hand. And so it is with the region’s growth. Not all East Africa’s economies are performing well, Kenya and Burundi being the two laggards. Long the most dominant economy in the region, Kenya is now the sick man of East Africa.

The label “sick man of Europe” is used to describe European states who are going through economic difficulties, social unrest, or impoverishment. When Nicholas I, Tsar of all Russian coined it mid 19th century, he was referring to the Ottoman Empire (now Turkey), then in rapid decline.

In modern times, the phrase was used on 1970s UK as her global colonial empire collapsed, amid economic ruin at home. In the last two years, the ignominy has gone to Germany. The industrial machine has not recovered well from Covid-19, posting the lowest growth among the G7.

Economic growth in East Africa is outpacing Central and Southern Africa regions, and projected to continue that trajectory. That growth is in part due to deeper regional integration. The EAC common external tariff is in full gear. The common market protocol – which allows free movement of people, goods and services is progressing, albeit in a limping fashion. However, the monetary union is yet to be realized.

Flawed democracy

And more free trade is in the air. Both the Africa Continental Free Trade Area (AfCTA), and the Tripartite Free Trade Area, comprising COMESA, SADC and EAC, are operational, the latter since July. This is good news for Africa’s manufacturing, which drives 43 per cent of current intra-Africa trade. It is estimated that the AfCFTA will double the size of manufacturing, creating 16 million jobs, and uplifting 50 million from poverty by 2035.

Kenya’s solid trade surplus in EAC is based on manufactured goods. It was therefore expected that the country would ride the expanded free trade area to spur growth. But early signs are troubling. This year’s growth will likely slip below 5 per cent. Having run out of fiscal headroom, debt financed growth is no longer an option. And the message of the most widespread civil unrest ever witnessed was emphatic. No new taxes.

What is troubling the Kenyan economy? I offer four explanations. Political choices, fiscal indiscipline, corruption, and a slow growth in credit to private sector.

A flawed democracy, Kenya’s modern 2010 Constitution is quite liberal. We hold regular elections, and have managed presidential succession quite well. But with exception on 2002, presidential contests have generally left the country divided right down the middle, with no president attaining a comfortable mandate since the return to democracy in 1992.

Moi’s two terms in the 90s were through minority votes. At that time, the winner was the first past the post, and the opposition were dividing up to 67 per cent of the vote amongst themselves. Kibaki’s second term was hotly contested. Uhuru first got into office with a narrow margin of .07 per cent above the constitutional 50 per cent threshold. He improved the margin slightly to 4 per cent in the annulled 2017 contest. Half the country stayed away from the court ordered repeat, so its outcome is misleading. He got 98 per cent of his half.

Rapid borrowing

Four presidents – Moi, Kibaki, Uhuru and now Ruto, have governed through coalitions, both formal and informal. Obtaining political support to create coalitions has contributed to fiscal indiscipline, the currency of exchange being state jobs and development projects. The most recent such effort is only two months old. Rocked by widespread civil unrest and the citizens’ sacking of parliament under a hail of bullets last June, the current regime had to cobble a coalition on the hurry-up.

Fiscal indiscipline loves corruption. And corruption loves fiscal indiscipline. Both thrive in coalitions. With government and opposition in bed, oversight wanes. Projects proceed at grossly inflated costs, amid vicious fights over their control. The design, build, and finance project delivery method is a favorite in that environment.

There is no doubt that roads, airports, ports, optic fiber, and railways are needed. However, infrastructure alone is not sufficient to create jobs and increase incomes. That requires a thriving production sector, using those roads, railways and ports to reach their markets and sources of raw materials. Kenya’s productive sector is compromised because infrastructure delivery has led to rapid borrowing and higher taxes. Borrowing has crowded out the private sector from the credit market, while high taxation has led to civil unrest.

Rapid borrowing while trying to control inflation has been a double whammy. High interest rates, combined with the high appetite for cash has increased government’s own debt service rapidly. Today, debt service is 70 per cent of ordinary revenue. The ratio of domestic to foreign interest payments is three to one. For every one shilling equivalent paid in interest on the foreign loans, three are paid for domestic borrowing.

High interest rates are squeezing the private sector into non-performing loans, the total loan book is shrinking, and economic growth remains muted. Only lower public expenditure can bring rates down, but will coalition politics allow Hon. Mbadi the space to heal the sick man of East Africa?

@NdirituMuriithi, an economist is partner at Ecocapp Capital