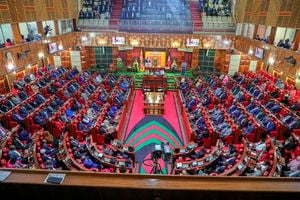

Derelict buildings and rusty equipment at Miwani Sugar factory on September 18, 2016.

| File | Nation Media GroupNews

Premium

From Miwani to Mumias: The sweet plantations of bitterness

When it was built in 1971, Mumias Sugar Company was supposed to be the largest sugar miller in Kenya.

Thousands of farmers had been removed from its radius – and parts of Mumias town – in the hope that a new sugar industrial complex would emerge with the support of new smallholder farmers.

Historical plans indicate a lofty dream: streets, schools, water schemes, hospitals, and shopping centres for a new sugar society.

Some 50 years later, the once-giant complex is on its knees, indebted, and with demoralised farmers all around watching some possible final acts of a tragedy and, possibly, a farce – though that was not the dream.

Mumias, just like Miwani Sugar Company before it, is going through motions of rot – and both have been caught up in politics.

While the Jomo Kenyatta government had introduced a new cash crop mimicking the age-old sugar belt plantations of the Caribbean, India and South Africa – but which was to rely on smallholder schemes apart from the nuclear farms owned by the factory – the Kenyan experiment has been bogged down by mismanagement, politics and cartels who command the sector.

The battles in the court corridors in Nairobi, far away from this sugar theatre, and the attempt by a receiver manager, Ponangipalli Rao, to lease the Mumias complex to a Uganda-based sugar manufacturer, Sarrai Group, illustrate the sugar wars that have left the farmer as the victim.

Mr Rao is facing challenges after he leased it to the lowest bidder, thus causing uproar in the sugar sector. It is the latest in the long-running woes of Mumias Sugar, which was indebted to the tune of Sh12.5 billion at the end of June 2018.

Mumias is not the first sugar miller to face such a tragedy, and there is fear that it could face the fate of Miwani, which collapsed in near similar circumstances.

In December 2007, as Kenyans prepared for a General Election, Miwani Sugar’s land was swiftly changing hands, ending a circus that had started in 1995 with the entry of wheeler-dealer Ketan Somaia, and some State House barons in the mix.

What is now known is that some Kanu politicos and the Treasury secretly handed over the complex in 1995 to Somaia, the owner of the collapsed Delphis Bank, through his firm, Venuses Associates. He had apparently contributed to Kanu campaigns for the 1992 elections, according to allegations made in Parliament. Miwani was his take-home project.

While Parliament was told by the Ministry of Agriculture that Somaia bought one million shares of Sh20 each or 51 per cent shareholding and that the government was left with 49 per cent, an attempt by MPs to get related documents was futile. It was then claimed in Parliament that Somaia did not pay for his shares. By then, Miwani owed farmers Sh250 million.

After Somaia ‘bought’ the shares, and as Parliament demanded answers, the baron shifted to Dubai, leaving farmers with unpaid debts. He never returned, and instead he swindled British multimillionaire Murli Mirchandani, triggering a case in which the British dubbed the Miwani owner the ‘King of Con’.

While the integrity of Somaia, later jailed in Britain, and that sale were questioned in Parliament, the tycoon used his 51 per cent shareholding in Miwani and the miller’s licence to import sugar.

Parliament was also told that Somaia was calling for board meetings in Dubai because Parliament’s Public Accounts Committee was demanding his appearance and answers. MPS Alfred Sambu and George Anyona told Parliament that Somaia was a conman – and had not paid for his shares.

“The Hindocha family which owned Miwani sugar factory for a long time had taken a Sh450 million loan from AFC. They defaulted in repaying…and this man called Somaia purported to pay on behalf of the Hindocha family. He did not pay any money and he is not going to do so and that is why he prefers to operate from Dubai because he is a conman.”

Today, Miwani lies in ruins, desolate and rusty. Because it is a private company, having changed hands, the government is unable to intervene. Even with all that, Miwani has an outstanding debt of more than Sh27 billion, part of which was guaranteed by the taxpayer when Somaia was in charge.

Promises made by the government over Miwani could also echo over Mumias.

“We cannot abandon Miwani Sugar, because the farmers around there have got no other source of income if this (factory) is allowed to disappear,” promised Isaac Ruto, an assistant minister for Agriculture.

But there were those who had doubts: “I think it is an anomaly in saying that the government will not let Miwani go to the dogs when it has already done so,” said Mukhisa Kituyi.

Finally, Miwani collapsed and left a trail of misery in its wake.

What we know from court records is that Miwani’s land, L.R. Nos. I.R 21038 and I.R 21039, was attached and sold by public auction through Jogi Auctioneers. The buyer was Crossley Holdings Ltd, which runs the private miller Kibos Sugar factory – perhaps confirming lawmakers’ fears that Miwani was deliberately brought down.

Dr Shem Ochuodho had alluded to this when he remarked that “the whole purpose of letting Miwani go under is to allow the politically correct people to buy it at a throwaway price and to start up another factory in the neighbouring Kericho area.”

When Miwani faced the receivership battles, the courts allowed the auctioning of its 9,300 acres, thus depriving the company of its nuclear estate – and the fallback it relied on for cane supply.

Sugar factories in Kenya rely on their own sugar estates, which are supplemented by smallholder farmers.

The Miwani dispute had started just like Mumias’. But Miwani was murky, although both offer a mix of business and politics.

It all started with a little-publicised case. Court documents detailed that on June 28, 1993, a Mr Nagendra Saxena filed a plaint demanding Sh40 million from Miwani, then in receivership, for consultancy services. Since the company was in receivership, there was a dispute on who was to be served – and the factory managers never appeared in court, giving way to an ex parte order.

The case dragged on in court for over 10 years, but finally the court allowed a public auction, triggering other cases as the factory went into ruin.

Last October, Kisumu High Court Judge Anthony Ombwayo ruled that there was no fraud, thus ending the government’s bid to recover the land sold for about Sh700 million. Justice Ombwayo ruled that the previous owner was Miwani Sugar Mills Ltd, a private entity, and now Crossley Holdings is demanding Sh6 billion it claims it lost when Miwani took its land.

There are fears in the sugar belt that Mumias could be the next victim, having gone through some of the motions that befell Miwani.

The Mumias saga started after KCB, which was the first to strike, went to court over a Sh545 million debt. The second was pan-African lender Ecobank, which had filed a notice last year for a forcible takeover of Mumias Sugar’s ethanol plant, claiming Sh2 billion. Others on the list include French development finance institution Proparco (Sh1.9 billion), which financed the construction of the power plant at Mumias, and Commercial Bank of Africa (Sh401 million).

After KCB filed insolvency proceedings, the bank appointed Rao as the receiver-manager on September 20, 2019. Later, Rao was appointed administrator via a November 19, 2021 ruling issued by Justice A Mabeya, with the court ordering that the receivership and the administration duties run concurrently.

Those who have challenged Rao’s current decision to lease the property to the lowest bidder say he was supposed to “conduct his duties with transparency and accountability”.

The court is now being told that he “has leased out the sugar factory and other assets of Mumias in an opaque and secretive manner to (Sarrai Group), who was one of the lowest bidders, in a move that stands to disenfranchise all the creditors of Mumias and ultimately, its shareholders.”

In the bids, which have been tabled in court, there were seven bidders interested in reviving Mumias Sugar. While the highest bidder, West Kenya Sugar Company, had offered Sh35 billion, the Sarrai Group pledged Sh5.8 billion, a difference of Sh30.2 billion.

While the battle in court is on who will finally control the multibillion-shilling sector, which was under Mumias for 50 years, the plight of cane farmers who have for ages watched their lifeline collapse under the weight of mismanagement and corruption seem to have been forgotten.

West Kenya Sugar has told the court that if its bid had been accepted, they would have had “the effect of ensuring that all of Mumias’ debts are repaid before expiry of the 20-year lease term”.

They also claim that with Sarrai’s bid, it will be hard “to realise any of Mumias’ historical debts … and Mumias will remain in debt eternally”.

In his defence, Rao told the court, in an affidavit sworn on January 19, 2022 that he awarded the lucrative tender to Sarrai on account that West Kenya Sugar would have emerged as a dominant player against the provisions of Section 23(2)(a) of the Competition Act 2010. In his papers, he says that had billionaire Jaswant Singh’s company been awarded the tender, they would have controlled 42 percent of the total sugarcane crushed in Kenya daily.

That is now a bone of contention in courts – since that is the task of the Competition Authority. West Kenya Sugar has claimed in court that Rao computed his figures by including the Naitiri factory, which is not in operation, and did not consider that much of Kenya’s sugar is imported, so nobody can dominate the sector.

The other poser is what would happen to the millions of shillings owed to cane farmers by Mumias and why the receiver-manager failed to impose a reserve price as it happens in auctions.

Two years ago, a government report indicated that state-run millers owed Sh90 billion to banks and suppliers – which meant that most of them were insolvent.

Mumias, for its part, was said to owe creditors more than Sh23 billion.

The other major question at the centre of the dispute was whether a listed company could have been leased out and what role the Capital Markets Authority was to play in this complex saga.

Interestingly, the government has 20 per cent shareholding in the listed Mumias while the balance is owned by various stakeholders. It also has 17.5 per cent shareholding in KCB – the bank that initiated the administration and receivership.

For years now, the government has been injecting capital into the enterprise but much of it is gobbled up by historical debts. For instance, in 2017, the government put in Sh2 billion but this did not resolve Mumias’ insolvency crisis.

Another question is whether the money that will be injected from the lease is enough to repay these debts and revive the factory.

Interestingly, the Kakamega County government has sided with the awarding of the lease to the lowest bidder.

Part of the problem in Kenya’s sugar plantations is that sugarcane pricing is still controlled by a committee that determines how much farmers should get though the sector was liberalised.

In neighbouring Uganda, there is no cane pricing policy. In that country, factories pay Sh3,000 while in Kenya they pay Sh4,500 per tonne, making sugar here more expensive.

With price controls, the Kenyan government has made sure that no single private interest can control the sector or emerge as a dominant player to fix prices.

Whatever happens to Mumias, the sugar terrain will be strewn with lessons learnt from Miwani and beyond.

But ultimately, it is the smallholder farmers who will bear the brunt of abandonment – if no revival formula is found.