New digital core for banks

Sponsored by Huawei

As the world continues to evolve, its residents are becoming more inquisitive in terms of finding novel solutions to current demands. Most of the solutions come in form of technological innovations.

Today’s technologically advanced world subscribes to the philosophy that life should be made easy, and the way of conducting daily business should be smooth sailing a larger extent.

The global banking sector, for instance, is fast moving from traditional to digital, incorporating FinTech at almost every level of transaction. There is an upsurge in digital banking and every financial institution is heading that way.

To construct a digital bank, a new ‘digital core’ that supports new technologies in banking service platforms or systems is necessary. Of course that should be somehow different from the initial traditional core.

In different countries and regions, banks build their new digital cores in different approaches, and in phases. The most commonly used approach is bi-modal architecture.

What is the bi-modal architecture?

Banking Core supported by traditional IT architecture has been used for many years and cannot be abandoned or completely modernised in a short period. On the other hand, banks need new architecture to support applications and services in open banking environments, such as mobile payment, micro-finance, and e-commerce. The scenario demands a bi-modal architecture.

What are the features of the new architecture?

The new architecture is normally open, distributed, or cloud-based. Banks and financial institutions in China have developed fast over the past 10 years. This can be attributed to two factors. Firstly, financial market competition has become increasingly intense, as domestic internet technology companies have risen rapidly. Secondly, China’s rapid economic development has driven IT progress too. For instance, a large number of internet-based transactions pose great pressure on banks. To cope, banks update their entire technical architecture to support both quick and elastic resource deployment and fast application iteration.

Meanwhile, with the change of user habits, traditional banks need to quickly develop applications, such as marketing and non-traditional financial services (life and e-commerce applications). This way, banks can acquire customers or attract the millennials to enhance competitiveness.

Therefore, traditional banks need to both maintain the stability of the traditional core and quickly build a new digital core. The digital core must be constructed using open and distributed technologies to better support the rapid development of next-generation applications, quickly acquire customers, and improve customer experience. It should also support the construction of the next-generation data platform, enabling banks to quickly develop and deploy innovative services.

In addition, banks need to keep their traditional core to provide traditional banking services, such as savings and general ledgers. These services have been running stably on traditional platforms for a long time.

Although many banks have migrated their service applications from the traditional core to the new digital core, in the foreseeable future, the two cores will coexist for a long time. That is why the bi-modal architecture is the mainstream one.

What are Huawei's solutions for the new digital core?

To support rapid horizontal scaling and the huge transaction volume, banks need distributed and open IT architecture designs. The traditional bank architecture is centralised and thus difficult to scale horizontally. On the contrary, the x86 architecture using various open and distributed technologies (such as MySQL database and Hadoop) is easy to scale horizontally.

Huawei has been dedicated to introducing the successful practices of digital transformation of banks in China in the past 10 years to overseas bank customers. Building the new digital core and architecture is one of these practices.

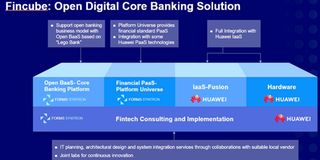

Since last year, Huawei has worked with leading banking service providers in China to develop a solution named Fincube.

This solution helps banks build a Lego-like distributed digital core banking system that converges IaaS, PaaS, and SaaS layers. In this solution, Huawei mainly provides the infrastructure architecture and distributed storage technology based on the IaaS layer of Huawei Cloud, while partners provide the PaaS layer technology and modular digital banking service system that can flexibly adapt to various service development and operations and management scenarios.

Since its launch, within a short space of time, this solution has been embraced by many customers. It has for instance been put into commercial use in a leading bank in Thailand. It does not only meet the bank’s requirements for developing internet financial services such as digital wallet and mobile payment, but also supports its open bank development strategy.

In the future, it will support more important national financial service development strategies and be applied to new ecosystem business models of banks.

In Kenya, Huawei, together with a leading bank software provider in China, helped the head bank build a new digital core system for financial inclusion within a short time. This clearly indicates that building a new digital core system has become a major trend of the industry.

With long-term cooperation with banks, Huawei, as a global enterprise, can more easily introduce this solution and best practices from China’s banking sector to its bank customers outside China, thus helping them successfully go digital and intelligent.